May Weekly Recap 1

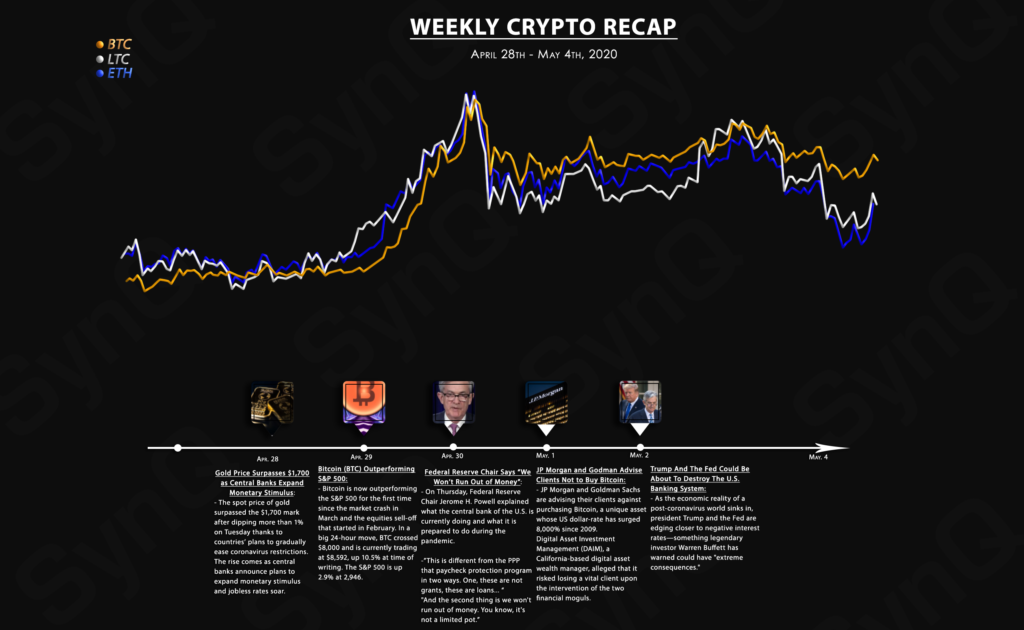

April 28th - May 4th, 2020

Welcome to our 1st weekly recap for May.

Overview

Crypto News

-

The spot price of gold surpassed the $1,700 mark after dipping more than 1% on Tuesday. The rise comes as central banks announced plans to expand monetary stimulus and jobless rates soar.

-

Bitcoin is now outperforming the S&P 500 for the first time since the market crash in March and the equities sell-off that started in February. In a big 24-hour move, BTC crossed $8,000 and is currently trading at $8,592, up 10.5% at the time of writing. The S&P 500 is up 2.9% at 2,946.

-

On Thursday, Federal Reserve Chair Jerome H. Powell explained what the central bank of the U.S. is currently doing and what it is prepared to do in the future to help the U.S. economy fight the economic impact of the COVID-19 pandemic.

- JP Morgan and Goldman Sachs are advising their clients against purchasing Bitcoin, a unique asset whose US dollar-rate has surged 8,000 percent since 2009.Digital Asset Investment Management (DAIM), a California-based digital asset wealth manager, alleged that it risked losing a vital client upon the intervention of the two financial moguls. The firm claimed that it has an institutional player who was ready to invest in Bitcoin but changed his mind after speaking to his advisors at JP Morgan and Goldman Sachs.

-

Donald Trump and the Federal Reserve have gone to extraordinary lengths to prop up the U.S. economy in recent weeks.

The coronavirus pandemic and the lockdowns put in place to slow its spread have ravaged the U.S. economy—with the Fed and the Trump administration pumping a staggering $6 trillion into the system since March and taking interest rates back to record lows to keep it on its feet.

Now, as the economic reality of a post-coronavirus world sinks in, Trump and the Fed are edging closer to negative interest rates—something legendary investor Warren Buffett has warned could have “extreme consequences.”

-