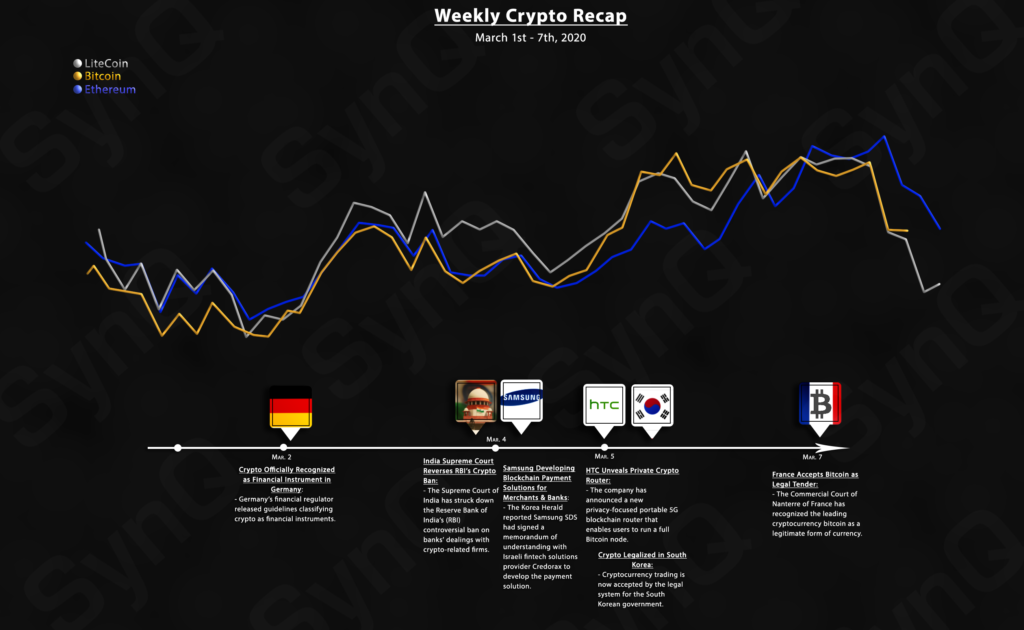

March Weekly Recap 1

March 1st - March 7th, 2020

Just like the January and February Report, our goal is to visually summarize the cryptocurrency market into an easy to understand and informative way. However, instead of the monthly duration, we will attempt to be more interactive with the market in a weekly format.

Overview

Crypto News

-

In a press release issued on Monday, March 2nd, 2020, the German Federal Financial Supervisory Authority (BaFin) clarified cryptocurrency as: “a digital representation of a value that has not been issued or guaranteed by any central bank or public body and is not necessarily linked to a currency specified by law and that does not have the legal status of a currency or money, but is accepted as a medium of exchange by natural or legal persons and can be transmitted, stored and traded electronically.” According to BaFin, the new classification echoes the guidelines of intergovernmental agencies like the Financial Action Task Force (FATF). BaFin’s new crypto classification announcement is also part of the move by the country to adopt the fifth EU Money Laundering Directive (AMLD5) which began on January 1, 2020. As part of the new BaFin crypto guidelines, cryptocurrency custodians will need to obtain a license for the regulator to offer their services in the country.

The Supreme Court of India has struck down the Reserve Bank of India’s (RBI) controversial ban on banks’ dealings with crypto-related firms. The court justices ruled that the RBI’s action was “disproportionate.” Key arguments in the case included the central bank’s contention that cryptocurrency is a digital means of payment and that the institution was “empowered by law” in its intervention.

Samsung’s enterprise is working on building a blockchain-based settlement solution for merchants and banks. The Korea Herald reported that Samsung SDS had signed a memorandum of understanding with Israeli fintech solutions provider Credorax to develop the technology, aimed to automatically logging payments data on bank records and ledgers. The product, yet to be named, will operate on Samsung SDS’ Nexledger Universal platform, a Samsung proprietary blockchain. Work processes will be automated using AI technology from Brity Works, another of Samsung SDS company.

HTC announced a new privacy-focused, portable, 5G blockchain router that is capable of running a full Bitcoin node. The Exodus 5G Hub follows on from the success of the Tawainese manufacturer’s Exodus 1 phones, which also have the ability to run cryptocurrency nodes. The Hub provides 5G connectivity to all internet-enabled devices and uses Zion Vault software to enable Bitcoin, Ethereum (including ERC-20 and ERC-721 tokens), Binance Coin, Litecoin and Stellar storage for users. The software offers additional security features including social recovery for private keys, allowing users to break up, encrypt and share recovery phrases among trusted parties.

The South Korean National Assembly amended the Act on Reporting and Use of Specific Financial Information and has allowed the use of cryptocurrencies within the country under regulations. After President Jae-in Moon signs the amendment passed in the country’s parliament, the enactment process will begin. It will take one year from the date of the signing, followed by a 6-month grace period. Once the required time passes, cryptocurrency-related businesses, such as exchanges, trusts, wallet companies, and token-sales, will need to comply with new rules. Requirements include having a real-name verification partnership with an approved local bank. The goal is to prevent money-laundering between fiat deposits or withdrawals.

The Commercial Court of Nanterre of France made a historic decision recognizing bitcoin as legal tender in the country. The ruling relates to a case between French cryptocurrency exchange Paymium and UK-based alternative investments firm BitSpread. Paymium had loaned 1,000 BTC to BitSpread before the Bitcoin Cash hard fork in 2017. After the bitcoin cash hard fork in 2017, Paymium and BitSpread both claimed that the bitcoin cash created belonged to them. The court ruled in favor of the borrower after recognizing bitcoin as a legitimate form of money.