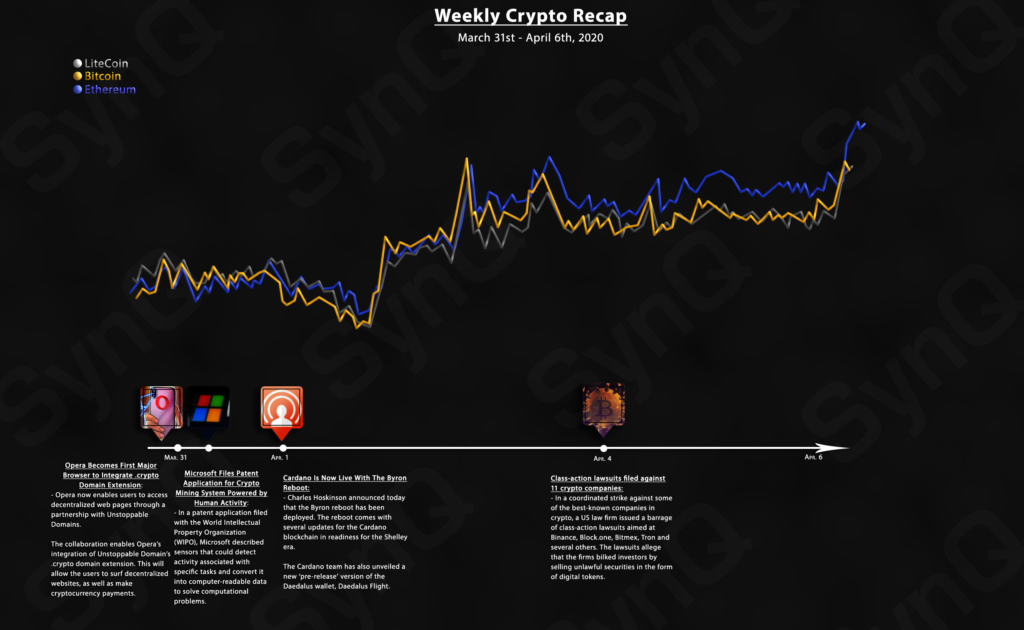

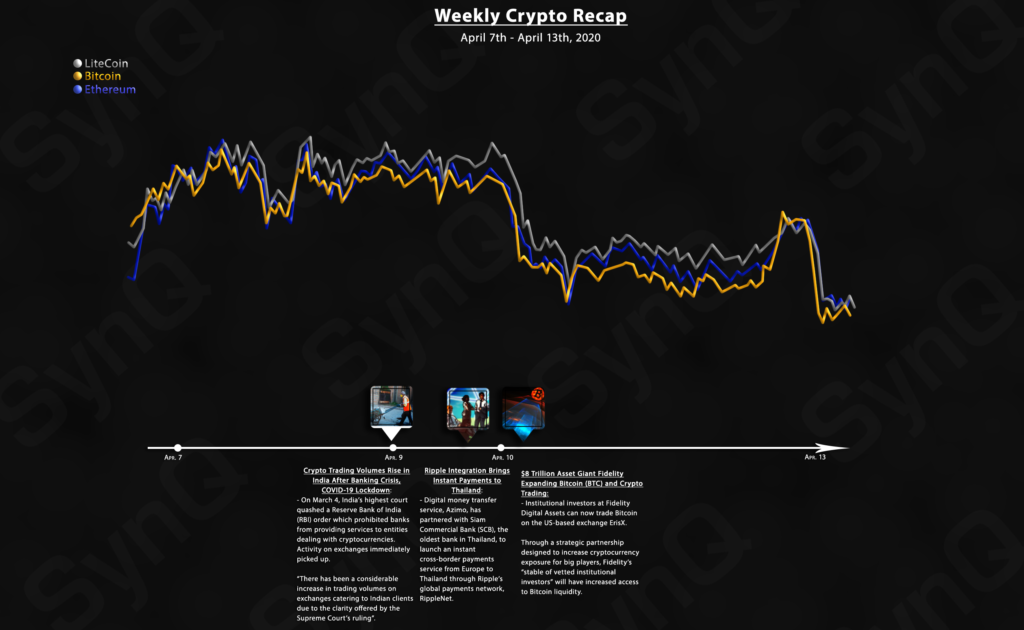

April Weekly Recap 2

April 7th - April 13th, 2020

Welcome to our 2nd weekly recap for April.

Overview

Crypto News

-

On March 4, India’s highest court quashed a Reserve Bank of India (RBI) order dated April 6, 2018, which prohibited banks from providing services to entities dealing with cryptocurrencies. Activity on exchanges immediately picked up.

The activity on exchanges further improved after Yes Bank, India’s fourth-largest lender, collapsed on March 6, damaging confidence in the country’s banking system.

The nationwide panic triggered by the Yes Bank crisis worked in favor of bitcoin, boosting Cashaa’s sales at a daily rate of 250 percent to 450 percent, according to data provided by the platform.

Digital money transfer service, Azimo, has partnered with Siam Commercial Bank (SCB), the oldest bank in Thailand, to launch an instant cross-border payments service from Europe to Thailand through Ripple’s global payments network, RippleNet.

- Institutional investors at Fidelity Digital Assets can now trade Bitcoin on the US-based exchange ErisX. Through a strategic partnership designed to increase cryptocurrency exposure for big players, Fidelity’s “stable of vetted institutional investors” will have increased access to Bitcoin liquidity.Fidelity Investments, which manages $8.3 trillion in customer assets, is also an investor in ErisX.