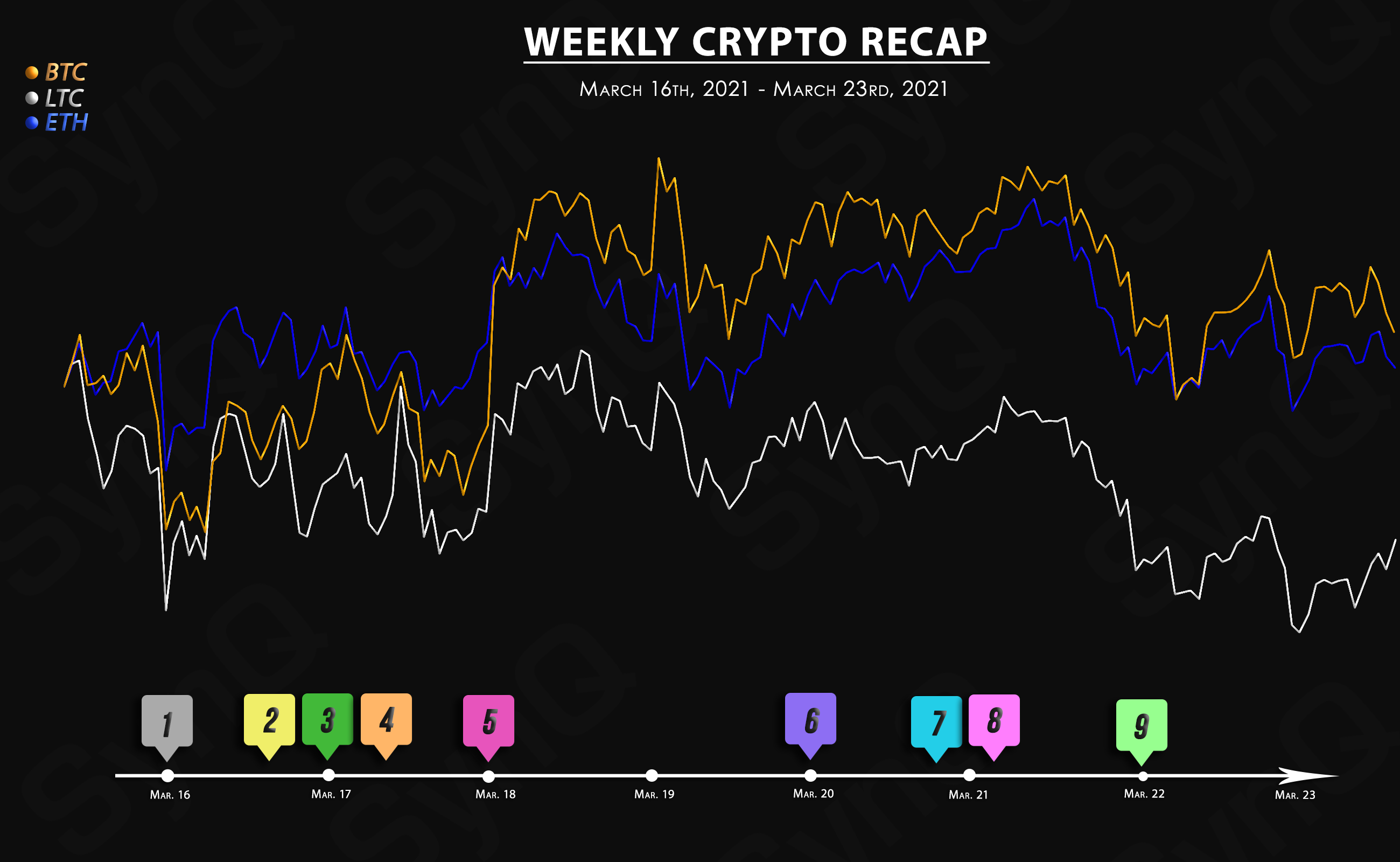

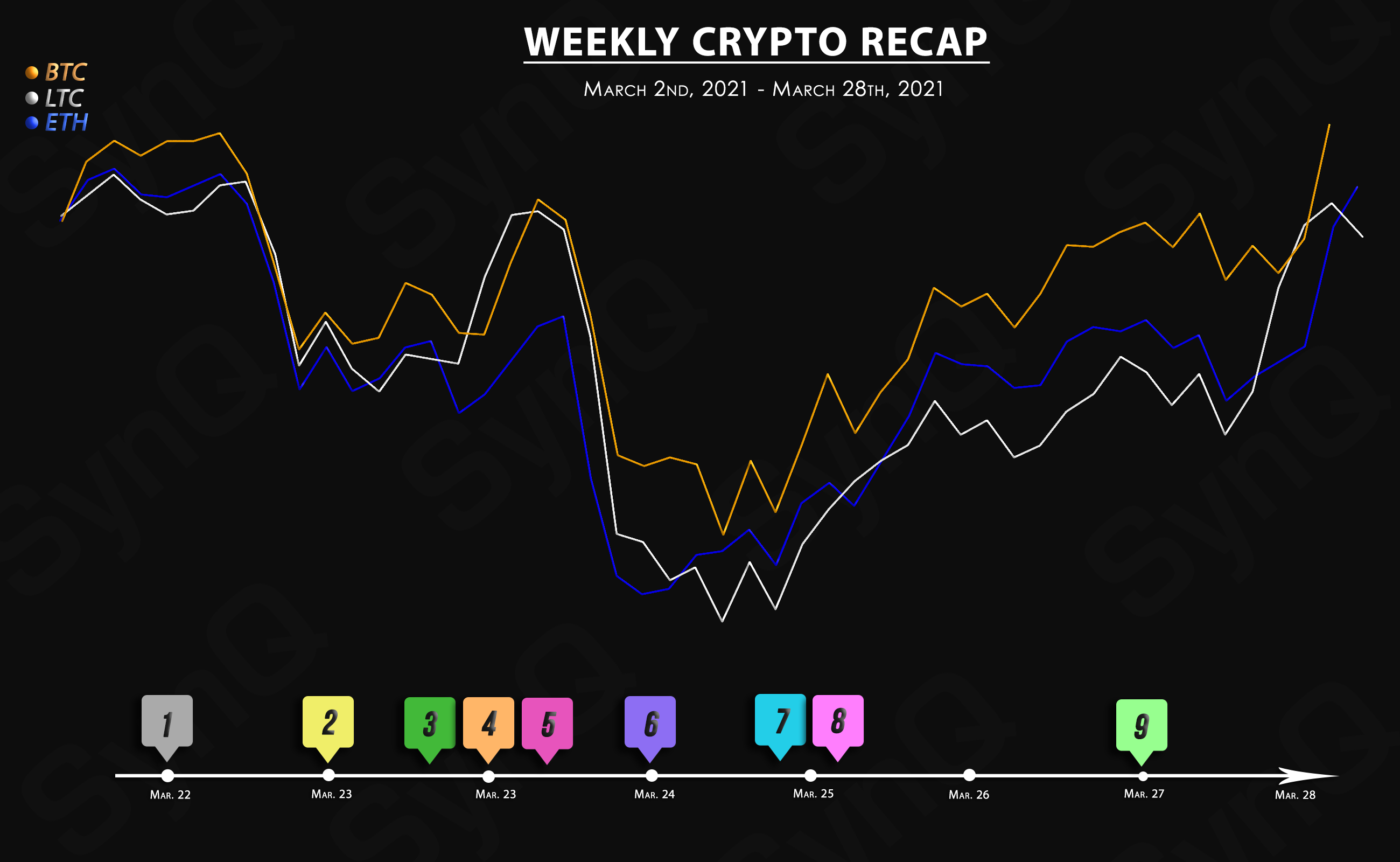

Weekly Recap

March 22nd, 2021 - March 28th, 2021

Welcome to our 4th weekly recap for March.

Overview

Crypto News

Digital asset manager QR Capital reveals that it received the green light to launch the first-ever Latin American Bitcoin exchange-traded fund (ETF).

Blockchain industry members claim that smaller-scale startups have struggled to forge partnerships with local banks in South Korea and are therefore unable to register under regulators’ new requirements.

According to a chart from analytics company CryptoQuant, on March 23, financial institutions bought and withdrew from Coinbase a staggering amount of crypto: 14,600 BTC.

Tesla is now running bitcoin nodes and “internal and open source software” to accept bitcoin for payments according to Elon Musk, Tesla’s CEO.

Filecoin, a decentralized network allowing users to store, request, and transfer data via a verifiable marketplace, today announced integration with Chainlink, the popular decentralized oracle solution.

Indian companies have been mandated to disclose their crypto holdings in financial statements, according to new rules that are coming into force on April 1.

It has been announced that Optimism, the Ethereum Layer 2 scaling solution, will be delaying the launch of its mainnet till at least July 2021. According to the official announcement, the new launch date is not certain as it still depends on the speed of preparations and “ecosystem readiness”.

Fidelity Investments, a financial giant with over $4.9 trillion in assets under management, has filed with the United States Securities and Exchange Commission (SEC) to list a new bitcoin exchange-traded fund (ETF).

Lately, Indonesia has been following in the footsteps of its close neighbor and business partner, Singapore, in exploring the use of blockchain technology and cryptocurrencies.