Weekly Recap

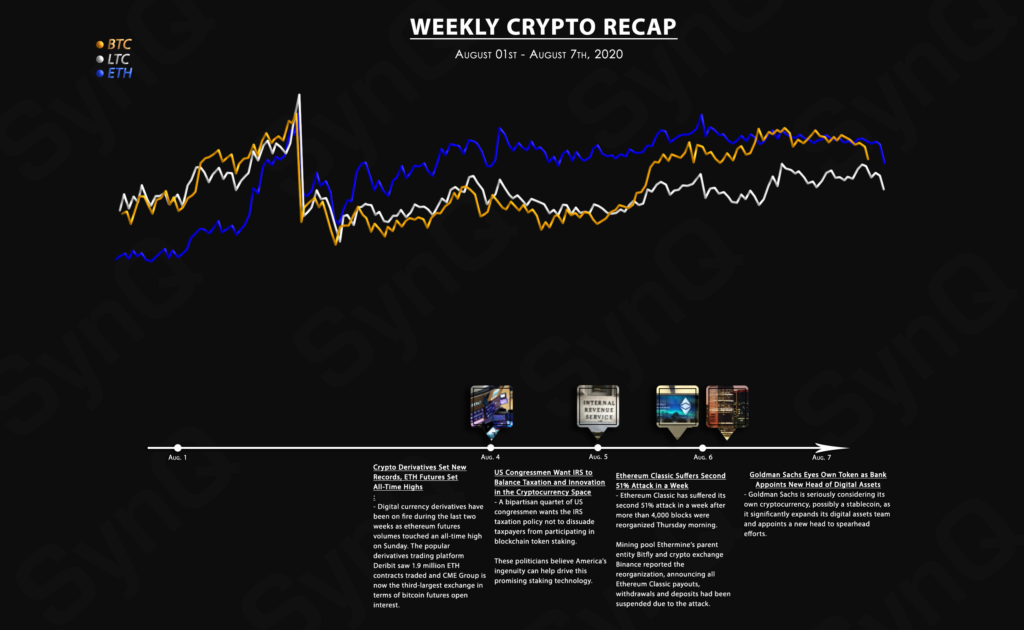

August 1st - August 7th, 2020

Welcome to our weekly recap for August.

Overview

Crypto News

-

Digital currency derivatives have been on fire during the last two weeks as Ethereum futures volumes touched an all-time high on Sunday. The popular derivatives trading platform Deribit saw 1.9 million ETH contracts traded and CME Group is now the third-largest exchange in terms of bitcoin futures open interest.

-

The four congressmen are Bill Foster (D) of Illinois, Darren Soto (D) of Florida, Tom Emmer (R) of Minnesota, and David Schweikert (R) of Arizona.

In their letter addressed to IRS Commissioner Charles Rettig, the quartet expressed concern that the “taxation of staking rewards as income may overstate taxpayers’ actual gains from participating in this new technology.”

-

Ethereum Classic has suffered its second 51% attack in a week after more than 4,000 blocks were reorganized Thursday morning.

- Matthew McDermott, Goldman’s new digital asset global head, confirmed the U.S. investment bank was exploring whether to launch its own digital asset, CNBC reported Thursday.

“We are exploring the commercial viability of creating our own fiat digital token, but it’s early days as we continue to work through the potential use cases,” he said. -

Source: https://twitter.com/synthetix_io

Source: https://twitter.com/synthetix_io

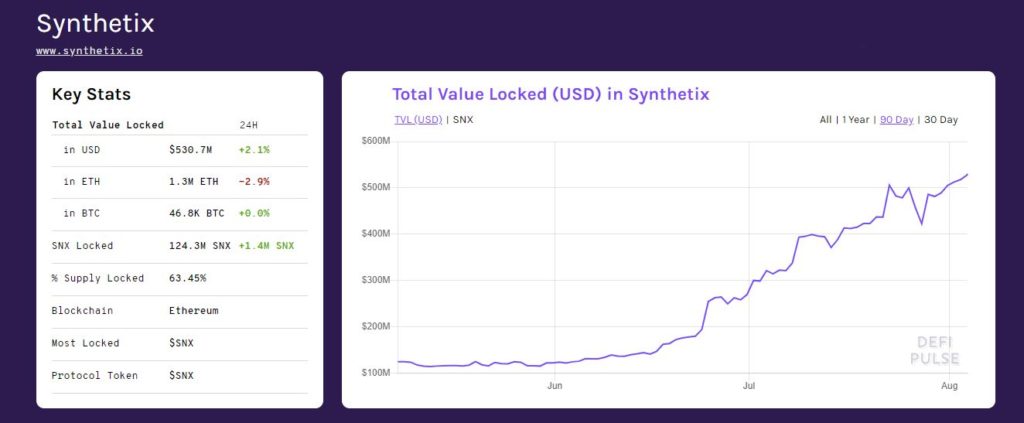

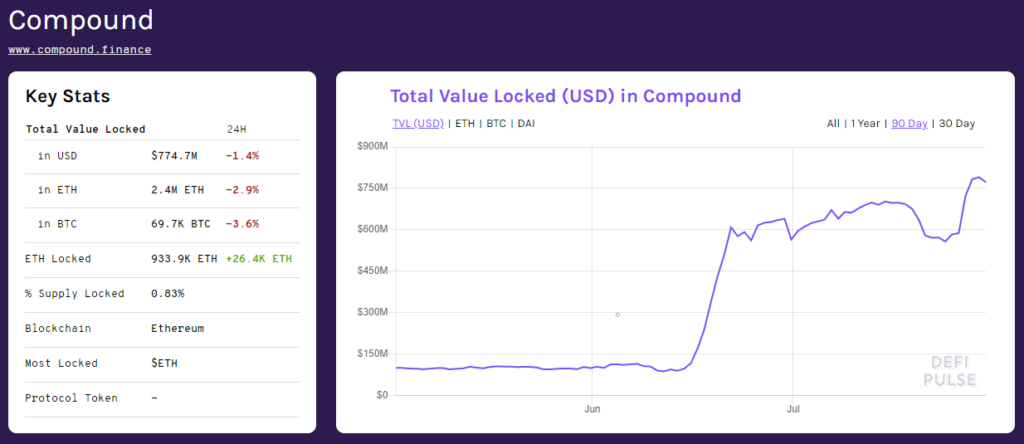

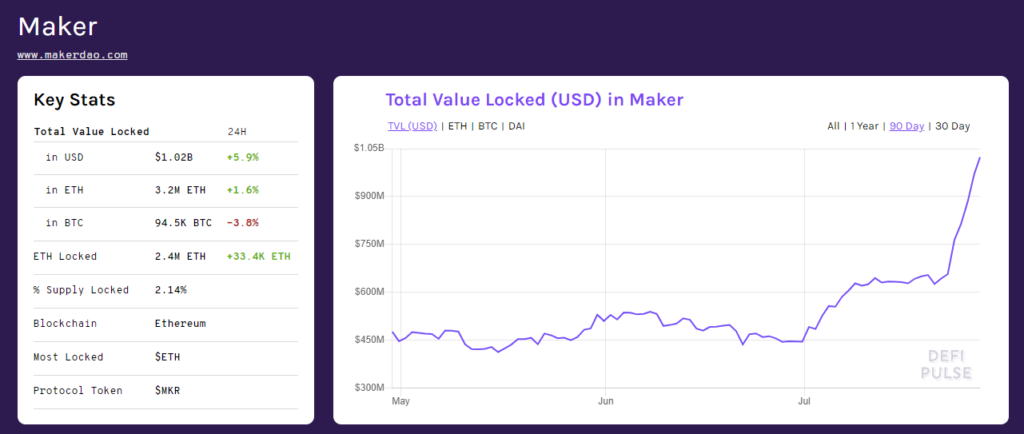

Source: (https://defipulse.com/)

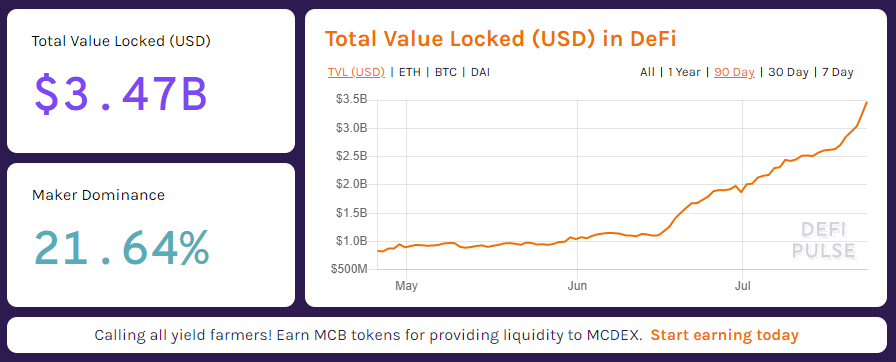

Source: (https://defipulse.com/)