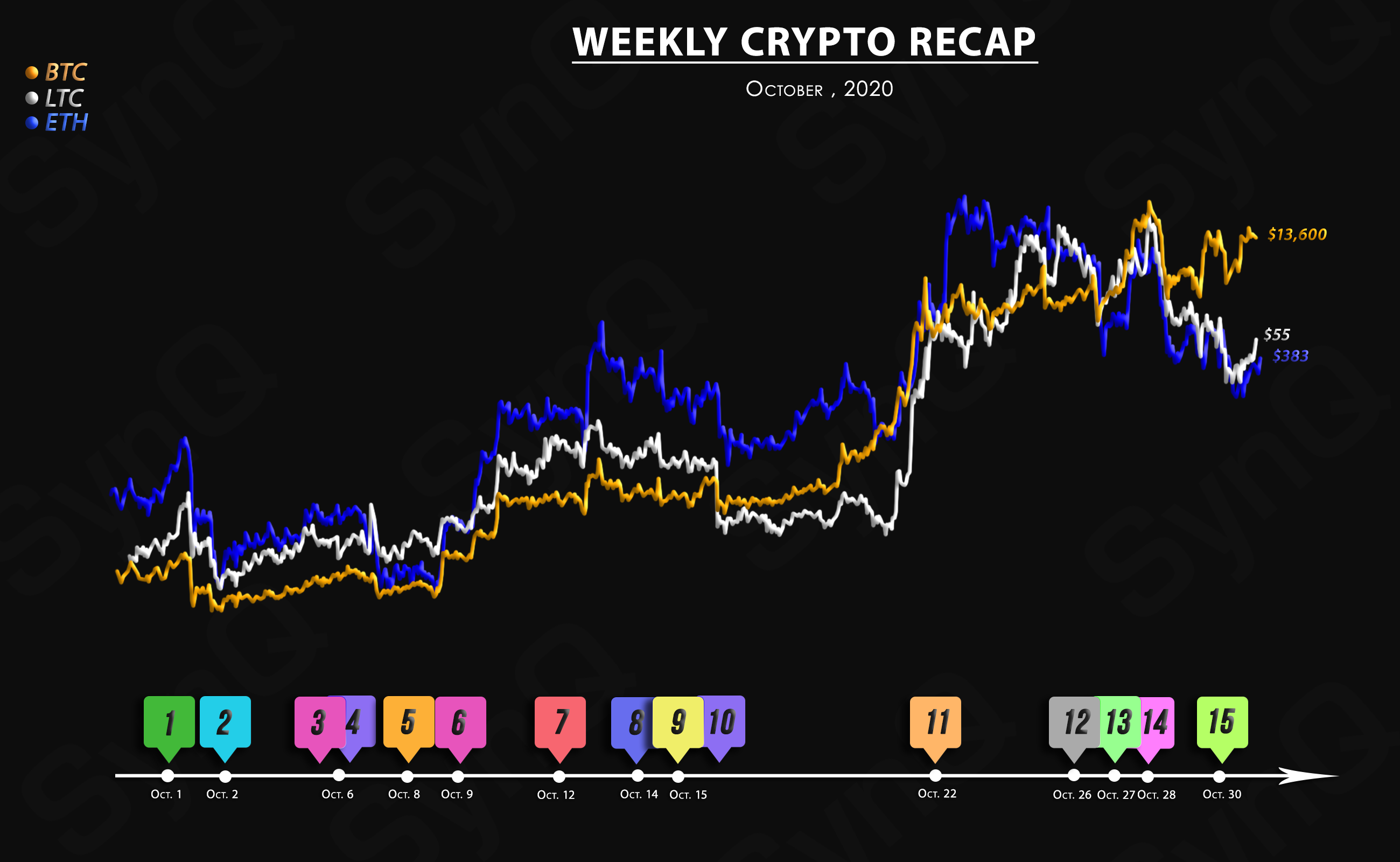

Monthly Recap

October, 2020

Welcome to our monthly recap for October.

Overview

Crypto News

The American FBI and CFTC are going after the largest Bitcoin derivatives exchange BitMEX for operating an “illegal” exchange.

CFTC and the U.S. Attorney for the District of New York have charged BitMEX for operating an unregulated exchange and non-compliance with KYC and AML guidelines.

Crypto exchange Coinbase is now offering “instant” withdrawals in nearly 40 countries, including the U.S. and the U.K.

The new feature is being facilitated via Visa and Mastercard.

The U.K.’s Financial Conduct Authority (FCA) has today officially banned the sale of cryptocurrency derivatives and exchange-traded notes to retail users, more than a year after first proposing such a ban.

The ban will come into effect on January 6, 2021.

In a press release shared with U.Today exclusively, Block.one unveiled that the global cloud monster Google Cloud intends to join the EOS community and become a Block Producer on the EOS network. Google Cloud joining in is a major milestone for EOS Google Cloud intends to become a block producer (BP) candidate on the EOS network and, after joining it, this branch of the global IT heavyweight will leverage EOS as it is taking steps to become one of its BPs.

Square, Twitter CEO Jack Dorsey’s payment company, has purchased $50 million worth of bitcoin.

The investment represents approximately 1% of Square’s total assets as of Q2 2020.

Square has become the second publicly-listed company after MicroStrategy to invest in bitcoin.

The authorities in China’s province of Shenzhen are planning to airdrop the soon-to-launch Chinese CBDC to its local residents. Reportedly, this will mark as the largest campaign initiated as part of the pilot program for the Chinese digital currency.

As reported by the South China Morning Post, citizens have been able to enter a lottery to receive the digital funds, of which coins worth 10 million yuan ($1.47 million) will be awarded to promote their use in roughly 3,400 designated stores in the Luohu district.

XRPL Monitor spotted gargantuan amounts of XRP moved by the blockchain behemoth Ripple. Meanwhile, large XRP movements have been noticed on various Ripple ODL partner exchanges, and the Binance giant transacted 13 mln XRP to the San Francisco-based tech company.

-

[9] Grayscale Adds $1 Billion to Crypto Products in Q3, Sees ‘Unprecedented Demand’ for Bitcoin Cash

Grayscale Investments has announced a record quarterly performance, raking in $1.05 billion in investments, mostly from institutional investors. The company also sees “unprecedented demand” for bitcoin cash.

Schnorr signatures and Taproot, formally the Bitcoin Improvement Proposals (BIP) 340 and 341, are two of the biggest changes to Bitcoin since the activation of Segregated Witness (SegWit)—an implementation which increased Bitcoin’s blocksize limit—in 2017. Schorr itself is based on the SegWit mechanism.

PayPal has finally decided to embrace crypto and will soon offer its U.S. customers the ability to buy, hold, sell, and use various virtual currencies, having obtained a New York license permitting it to do so.

Hackers obtained USDT and USDC stablecoins worth $24 million from Harvest Finance’s stablecoin and BTC pools.

Harvest’s governance token FARM plummeted 60% following the revelation of the hack.

$400 million in total liquidity have been drained out of Harvest Finance as liquidity providers (LPs) flee the platform.

Dubbed “DBS Digital Exchange,” the trading platform would allow users to trade in four crypto assets — bitcoin (BTC), bitcoin cash (BCH), ether (ETH), and XRP — against Singapore dollar (SGD), Hong Kong dollar (HKD), Japanese yen (JPY) and U.S. dollar (USD).

As cryptocurrency analyst Jason Deane explained in his recent coverage of these price milestones, the fact that BTC/lira has hit an all-time high, while BTC/USD has not, indicates that the lira’s purchasing power against the world reserve fiat currency has weakened.

JPMorgan Chase announced that its native digital currency offering — the JPM Coin — has finally been deployed for mainstream use by one of the firm’s technical associates. The token is designed to facilitate JPMorgan Chase’s various cross-border monetary transactions.

Related News

Financial institutions and money service providers using the San Francisco startup’s XRP-powered, cross-border payment product, On-Demand Liquidity (ODL), can borrow Ripple’s native currency for a one-time fee via an approval system that will move faster than legacy financial options, according to a press release.

According to data shared by the XRPL Monitor bot, San Francisco-based tech behemoth Ripple has conducted several large transactions, transferring approximately 100 mln XRP between its wallets and sending part of the money to its ODL corridor in Europe.