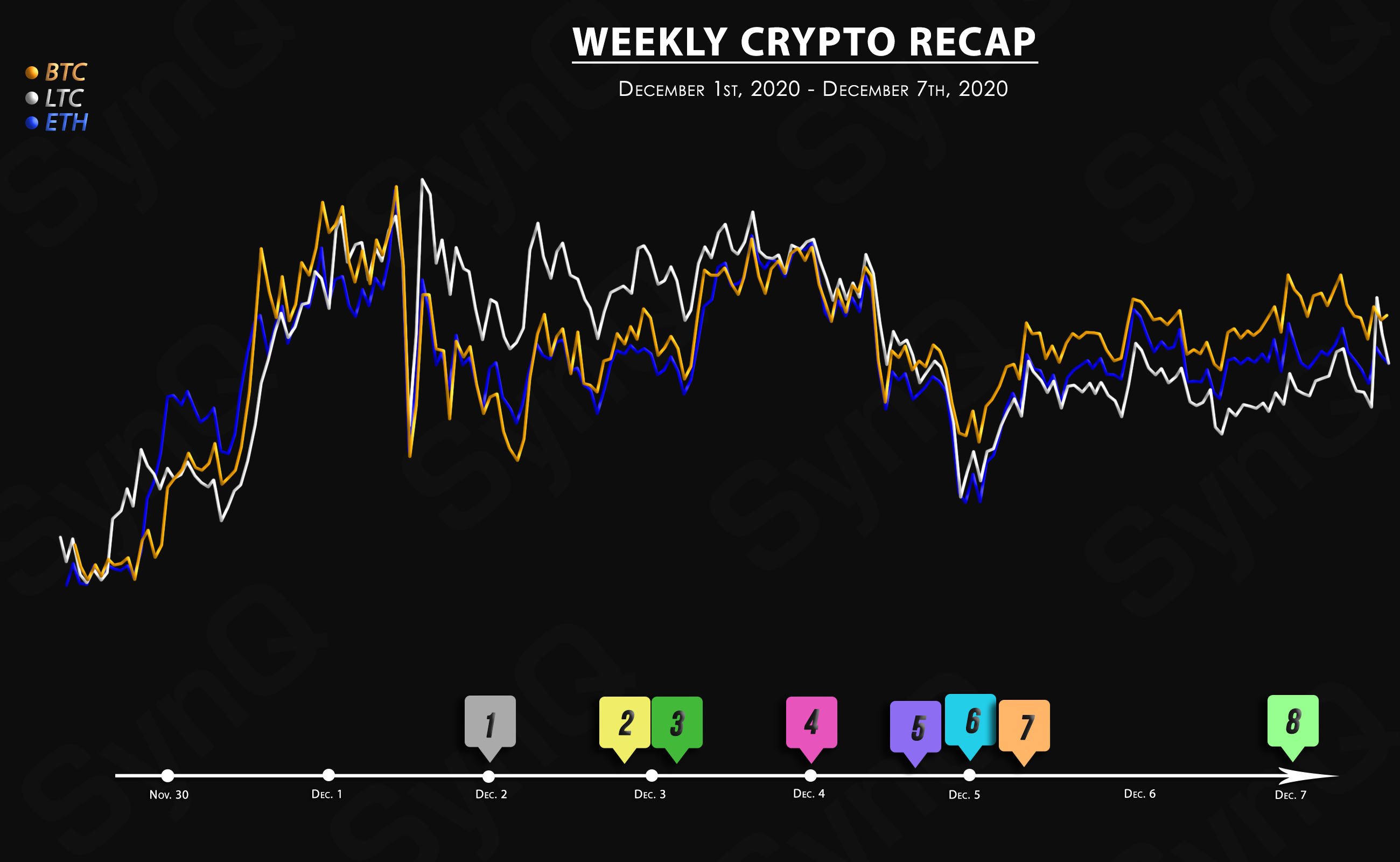

Weekly Recap

December 1st, 2020 - December 7th, 2020

Welcome to our 1st weekly recap for December.

Overview

Crypto News

While volatility in crypto has kept some payment companies at bay, Visa has plunged in to connect Visa’s payment system with USD Coin (USDC). USDC was developed by Circle, a company that specializes in digital payments.

According to Fundview, Hauck & Aufhäuser will roll out a crypto fund via its Hauck & Aufhäuser Innovative Capital (HAIC) GmbH subsidiary in Jan. 2021. Dubbed HAIC Digital Asset Fund I, the product will focus on Bitcoin (BTC), Ether (ETH), and Stellar (XLM).

S&P Dow Jones Indices announced on Thursday that it will be launching its own cryptocurrency indexes. The new products will reportedly go live in 2021.

According to data shared by Bybt analytics service, over the past 24 hours, Grayscale Investments fund spearheaded by Barry Silbert acquired another large amount of BTC.

Grayscale has added 7,188 BTC to its crypto holdings – that is $136,960,870 at the current exchange rate.

Grayscale, the Bitcoin Trust custodian and digital asset manager, has added another $140 million worth of Bitcoin to their Bitcoin Trust portfolio within the last 24 hours.

The world’s first ethereum Exchange Traded Fund (ETF) is undergoing an Initial Public Offering (IPO) at the Toronto Stock Exchange (pictured) under the ticker of QETH.U.

Next week, Canadian digital asset investment manager 3iQ will be launching an IPO of an Ethereum exchange-traded trust, The Ether Fund, on the Toronto Stock Exchange (TSX) under the ticker QETH.U.

In its Dec. 7 press release, the United States Department of the Treasury (USDT) mentions that the finance ministers of the G7 countries voiced strong support for regulating cryptocurrencies during a recent video conference:

There is strong support across the G7 on the need to regulate digital currencies. Ministers and Governors reiterated support for the G7 joint statement on digital payments issued in October.