SynQ is a highly accurate, automated crypto forecasting application built from business intelligence methodologies. This means we focus on consumer trend, sentiment, and market data to create SynQ’s predictive data analytics outcomes. SynQ looks at consumer trends, the attention economy, social media, language, and wide sets of market information. The aggregated data set allows the SynQ algorithms to create hundreds of price projections, per day, for the Top 100 cryptocurrencies – with alarming accuracy.

SynQ Provides

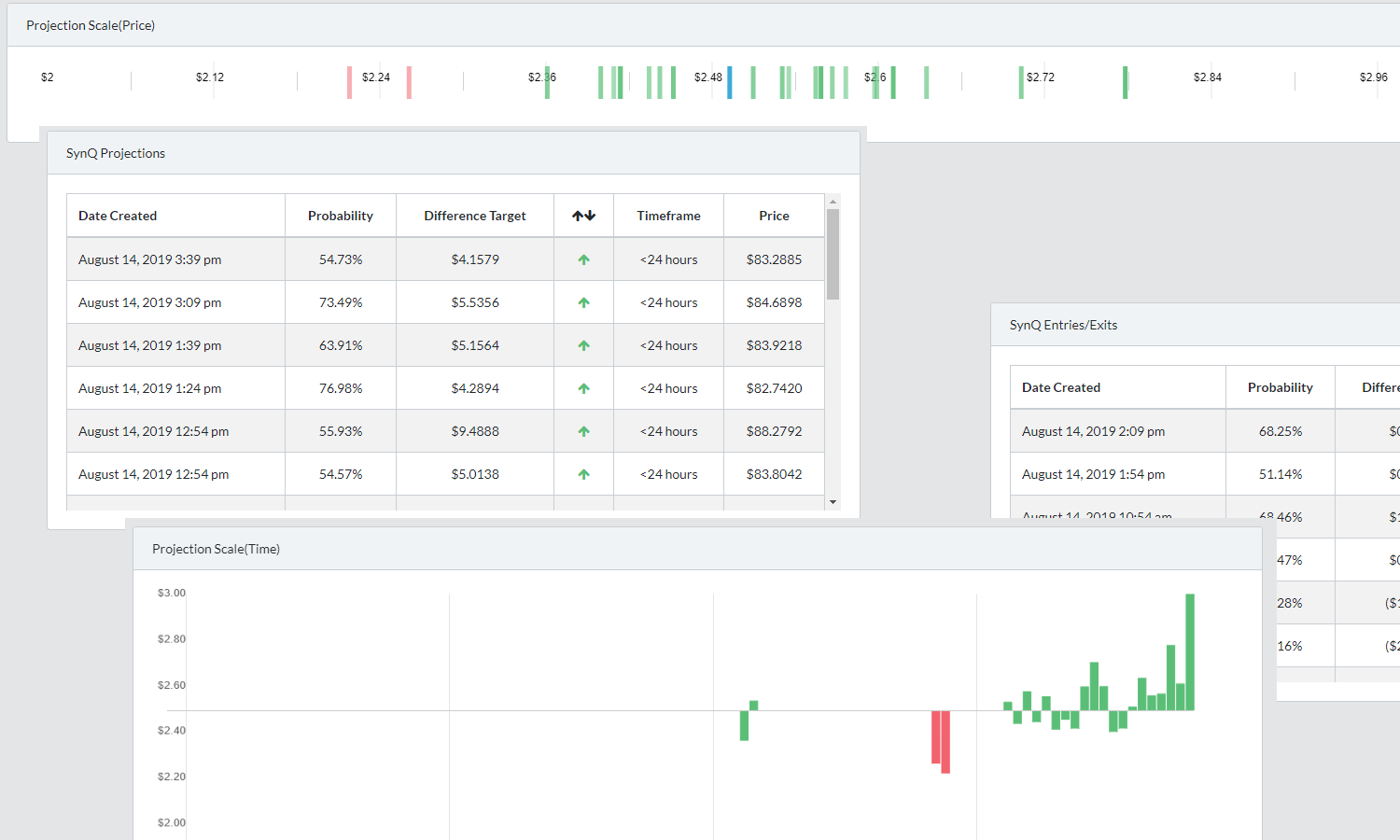

- Accurate Price Projections

- Projection Gauge

- Projection Timescale

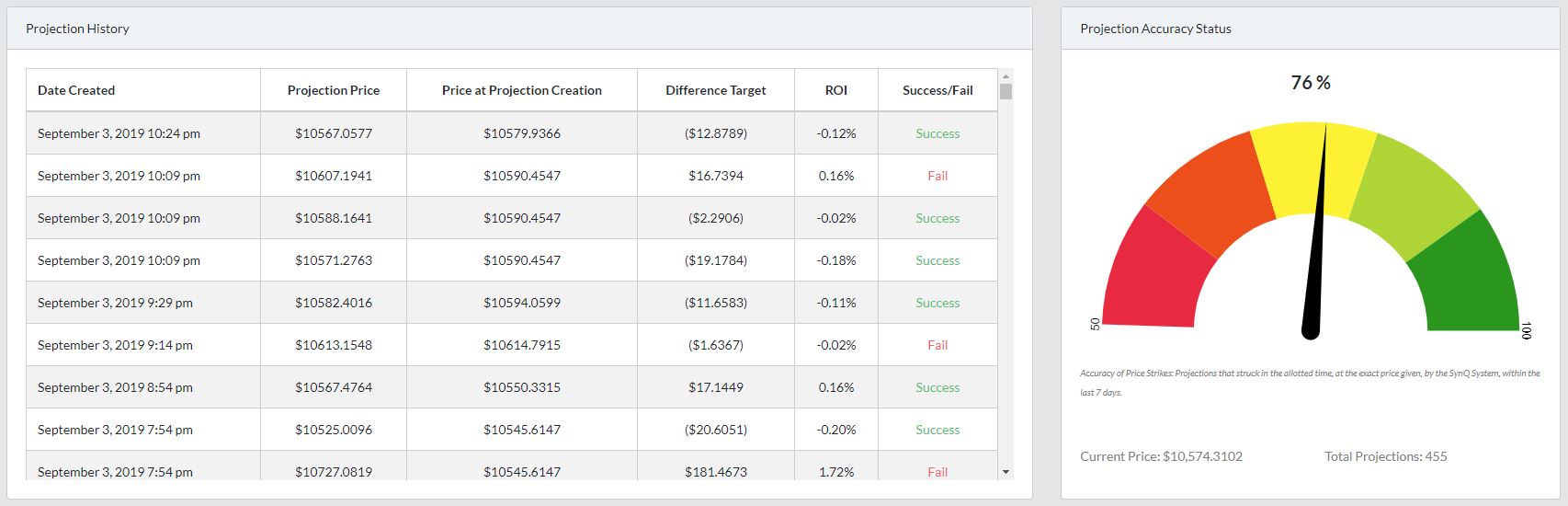

- Projection Accuracy Status

- Social Influence Chart

- Buy vs. Sell Pressure

- Social Quantity

- News Headlines

SENTIMENT DATA & BUSINESS INTELLIGENCE

Sentiment Analysis

- Number of Tweets

- Number of News Articles

- Language Polarity

- Number of Social Media Posts

- Amount of Engagement

- Social Spread of Content

Business Intelligence

- Consumer behavior

- Mindset as reflected in social media

- Reactions to news

- Correlations between knowledge and action

- How language affects an asset

- Industry resonance among consumers

FEATURES

Track up to 6 assets to view predictive outcomes within 10-trusted cryptocurrency exchanges. Each projection is continuously backtested to challenge the outcome in real-time.

Create price alerts between any exchange-available trading pair to be notified, SynQ-wide, when the market price strikes.

See when buy pressure and sell pressure, social impact, and market cycles in the consumer attention economy are changing tides, in near real-time.

TRANSPARENCY

75/80% Accuracy

We’re very keen on the fact that SynQ needs to be able to be trusted, it’s our job to prove to you that the data we provide is accurate to our claims.

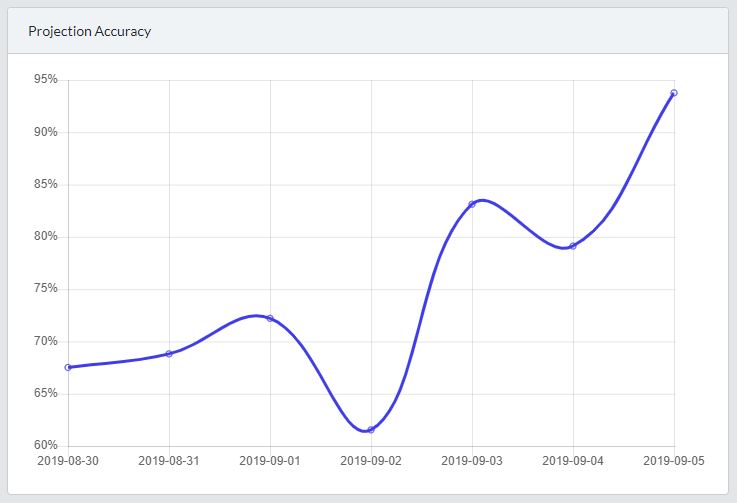

Truth be told, we didn’t believe the results ourselves. We scrutinized the outcomes to obscene levels and found all the ways to poke as many holes in the SynQ system as possible. We wanted to be sure we were telling people exactly what SynQ’s cryptocurrency forecasting was capable of. Some days, the application pushes over 88% accuracy, some days it “slips down” to 72% accuracy.

We hold SynQ to a high standard of exact price matches, within a specified time frame. This means: on time, on price target, exact direction. If the projection is wrong, even by 1/100th of a penny, it is marked as a failure in the system and impacts our overall reporting accordingly. This is a high standard of excellence we hold ourselves to – and will continue to – so that you can have the best information out there when trading.

If we’re more than 60% accurate day one, I’ll be happy with the results, and improve on it from there.

– Enrique Gutierrez, CEO, May 3rd, 2019