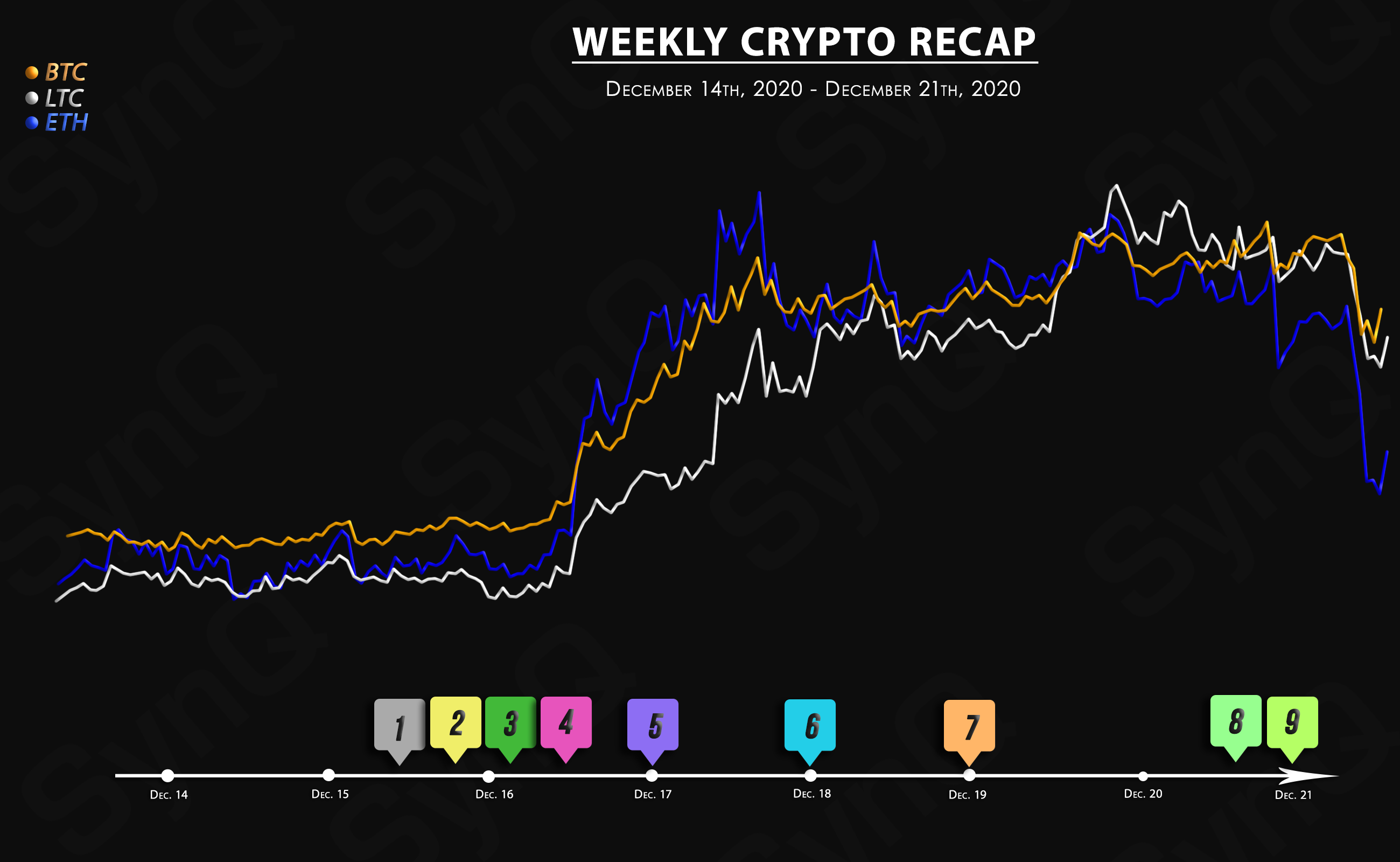

Weekly Recap

December 7th, 2020 - December 14th, 2020

Welcome to our 2nd weekly recap for December.

Overview

Crypto News

According to its Dec. 16 press release, CI Global Asset Management has wrapped up the initial public offering (IPO) of its CI Galaxy Bitcoin Fund.

The CME Group, a global markets company, and the world’s largest financial derivatives exchange, has announced that it will be launching Ether futures contracts for institutional traders.

Germany has passed a law that allows electronic securities to be recorded on a blockchain, according to reports from Reuters.

Popular bitcoin exchange company Kraken, today announced new investments and forthcoming features designed to bring the benefits of Bitcoin’s Lightning Network to its global exchange.

Cryptocurrency exchange Coinbase has confidentially filed a registration statement with the U.S. Securities and Exchange Commission (SEC).

After weeks of speculation that the Treasury Department was working on regulations that would affect crypto wallets, the Financial Crimes Enforcement Network (FinCEN) today issued proposed rules that would “require banks and money service businesses (‘MSBs’) to submit reports, keep records, and verify the identity of customers” who make crypto transactions into unhosted (read: private) wallets.

The Financial Crimes Enforcement Network (FinCEN), an agency of the US Treasury Department, has proposed a new set of rules that would require financial institutions to keep a record of certain transactions sent to private cryptocurrency wallets.

The Binance-backed exchange has added decentralized stock trading for Big Tech mainstays Facebook, Amazon, Netflix and Google. The update is the result of a partnership with Terra and Band Protocol.

As per the latest tweet by CEO Michael Saylor, his business software giant MicroStrategy has just acquired another massive lump of Bitcoin—29,646 Bitcoins worth a whopping $650 million raised recently from investors.