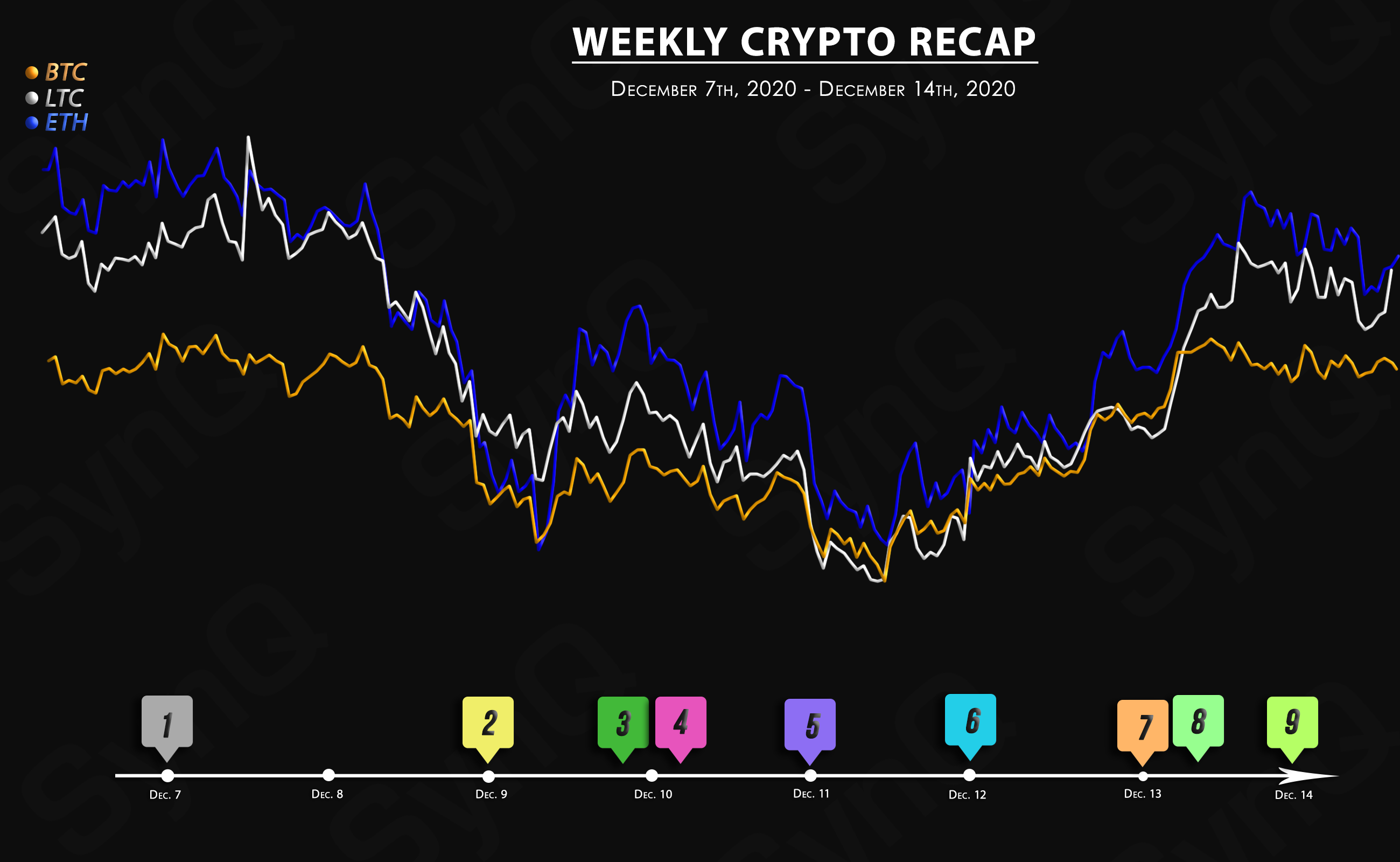

Weekly Recap

December 7th, 2020 - December 14th, 2020

Welcome to our 2nd weekly recap for December.

Overview

Crypto News

Finance Ministers and Central Bank Governors of the G7 nations are reportedly unanimous in their call for robust crypto regulations.

Fidelity Digital Assets, the cryptocurrency arm of the Boston-based mutual fund empire, is set to offer Bitcoin-collateralized dollar loans, according to a Dec. 9 report published by Bloomberg.

In what is yet another victory for the still-nascent crypto-market, DBS, Southeast Asia’s biggest bank, has announced that it will launch a cryptocurrency exchange. The planned digital currency exchange will offer Bitcoin (BTC), Ether (ETH), XRP, and Bitcoin Cash (BCH).

Grayscale Investment Trusts added another $240 million or more worth of crypto this week.

Up to 100,000 ETH were also purchased by the company, which now trades at over a 120% premium.

Grayscale, the Bitcoin Trust custodian and digital asset manager, has added another $140 million worth of Bitcoin to their Bitcoin Trust portfolio within the last 24 hours.

Business intelligence firm MicroStrategy has completed a $650 million debt offering of 0.750 percent convertible senior notes, according to its Dec. 11 press release.

A new feature in Lumi’s iOS wallet allows traders to buy crypto assets through Apple’s popular payments service.

Cardano announced that Bondly is bringing new DeFi capabilities to its platform. Cardano expects to launch its major Goguen upgrade by end-February 2021.

It appears that Pornhub, the world’s largest adult website, is only accepting crypto for its premium service. The move was noticed on the site today after Visa and Mastercard cut off payments to the website last week.